The financial services industry could be doing more to manage their exposure to the significant risks posed by a climate change phenomenon that is only worsening. Neglecting the micro and macro intricacies of climate change and failing to incorporate its associated risk into a risk agenda and/or framework can result in grave consequences that could otherwise have been avoided or mitigated While it is true that firms within the financial services industry will, at least initially, be disproportionally impacted by climate change owing to their relative size and portfolio compositions, failure to act accordingly and plan for the future can and will lead to adverse consequences. In a 2020 annual letter to fellow CEOs, Blackrock CEO Larry Fink wrote:

“Over the 40 years of my career in finance, I have witnessed a number of financial crises and challenges – the inflation spikes of the 1970s and early 1980s, the Asian currency crisis in 1997, the dot-com bubble, and the global financial crisis. Even when these episodes lasted for many years, they were all, in the broad scheme of things, short-term in nature. Climate change is different. Even if only a fraction of the projected impacts is realized, this is a much more structural, long-term crisis. Companies, investors, and governments must prepare for a significant reallocation of capital.” [1]

The idea that climate change will act as a long-term and persistent threat to stability within the market should thus spurn financial services firms to action, as Fink had laid out. As climate-related risks continue to materialize at an alarming rate, firms will find themselves expanding their efforts on mitigating the impact of adverse effects at the expense of planning adequately to better protect themselves on a go-forward basis. For instance, insurance and real estate companies will be put into a position where they will need to adequately increase the premiums that they charge to clients in accordance with intensified weather phenomena and sea-level rise. Most firms in the industry today are aware of the substantial risk factors associated with climate change and how they could potentially lead to economic harm in the future. The issue that we are currently tasked with today is how to ensure that all firms within the industry become aware of this reality.

From Climate Risk to Financial Risk

The question of how the environmental consequences of climate change will filter down to the financial system is often one that is overlooked and misunderstood. The exact timeframe of its various consequences is still debated, leading to often uncoordinated responses to the inevitable havoc that climate change promises to wreak on the financial services industry. . What is clear however is the feedback loop that will be created by these climate risks, whereby said risks will result in changes in the value of financial assets, cost/availability of liquidity/credit, and the overall accessibility of risk-mitigation instruments. These same climate risks will also lead to the proliferation of risks to economic activity, manifesting in unemployment, production shocks, and service sector disruptions. These threats will further increase the financial risks that will already be present in the economy due to the climate risks themselves.

It is apparent then that even minor changes in the climate can have disastrous effects upon the financial services industry, mainly due to the threats posed to both physical capital as well as financial assets. Ambiguity on when and how climate change will materially impact the sector is often the catalyst behind underreported risks and the possibility of broad repricing after a shock. A lack of information related to the potential physical risks can lead to asset mispricing through high levels of effective leverage and the unpredictable timing of the direct effects of climate change itself. Additional risks to financial stability could also be created by exceedingly quick and unpredictable changes in the climate which will nullify the effectiveness of existing climate models and historical data. The inability of forecasters to predict such correlated shocks as they occur over longer periods of time and negatively impact all market participants will result in ineffective estimates of risk in the market[2]

Preparing for Transition

Considering these mounting challenges and the sheer unpredictability of climate risks, it is clear that the FIRE (Finance, Insurance, Real Estate) sector as a whole is almost certainly underestimating the systemic risks that pose a major threat to the stability of financial services. Accounting for these climate risks at a more discrete level as well as investing in more accurate data capture methods can help protect and move the industry in the right direction. Other costs that need to be accounted for are those that are associated with the switch to a greener economy, which ultimately presents promising opportunities to potential investors, specifically in the form of transition bonds, ESG (Environmental, Social, and Governance)-linked interest rate swaps and insurance premia-linked financing. While sustainable and transition-linked investments are a major upside of the upcoming green transformation, a top-down approach by financial services firms will be crucial due to the urgency of the situation and to ensure that risk at a firm-wide level is rapidly accounted for.[3]

Assessing the Risks

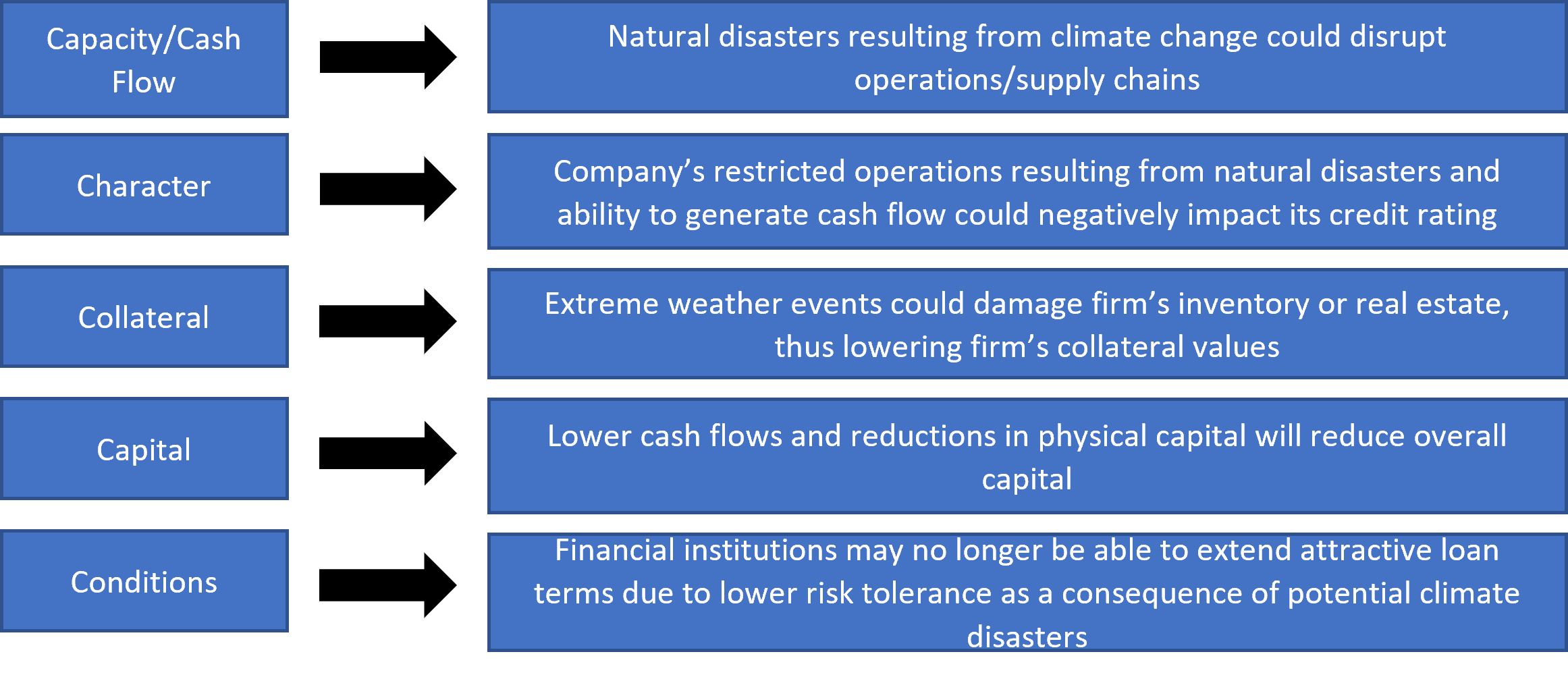

To more accurately verify the material risks to the financial services industry, it must first be understood that climate change poses multi-dimensional challenges to all firms. Institutionally speaking, credit risk itself is usually assessed via the “5 Cs of Credit” (Capacity, Character, Collateral, Capital, and Conditions) and with respect to climate risk, all five are affected by it.

For each of the “5 Cs”, financial services firms must begin to embed climate risk into existing risk assessments due its immediate and all-encompassing effects on credit risk. Firms should, therefore, strive to create new teams dedicated to countering these risks within ESG or CSR groups.[4] Financial services companies will likewise need to come to the realization that climate risk will continue to be an unavoidable factor in not only their calculations regarding credit risk but also within all facets of the entire business decision making process. This reality should have each firm reassessing their governance structure and strategy in order to ensure it is mapped directly to their climate-risk exposure. Intrinsic to the success of this exercise is the introduction of integrated management reporting systems that not only facilitate a better understanding of climate risks from a financial perspective but more effective climate-related communication with clients.

Capitalizing on the Risks

A renewed and proactive approach to countering climate risks in the financial services industry must take into account an increase in demand for ESG products and investment strategies amongst industry participants. For investment and wealth management firms, they will be pressed to offer a wider array of various customized products and services for climate risk-averse clients based on more comprehensive ESG data capture techniques. These same companies will therefore need to offer greater transparency to their clients with respect to how their ESG climate metrics compare with the overall performance of the market. As the range of offered ESG products continues to expand, financial services firms will need to identify gaps in their data and perform the required analysis to better identify weaknesses and subsequent opportunities with respect to their investment strategies and disclosures to clients. Greater transparency into methodological construction will need to be communicated to investors in response to a rise in investor demand for climate risk-averse products and a higher degree of portfolio data granularity[5]

As any successful investor would agree, a successful investment strategy needs to account for factors that are often times nearly impossible to predict with 100% accuracy. Because of the far-reaching and momentous effects of climate change on the industry, every financial services firm will thus need to apply a similar level of effectiveness in the future when it comes to making preparations.

[1] https://www.blackrock.com/corporate/investor-relations/2020-larry-fink-ceo-letter

[4] https://www.moodysanalytics.com/articles/2021/climate-risk-is-heating-up

[5] https://www2.deloitte.com/xe/en/insights/industry/financial-services/climate-change-financial-services-risk-opportunities.html