Regulators Adopt Recommendation to Delay Phase 5 and Phase 6

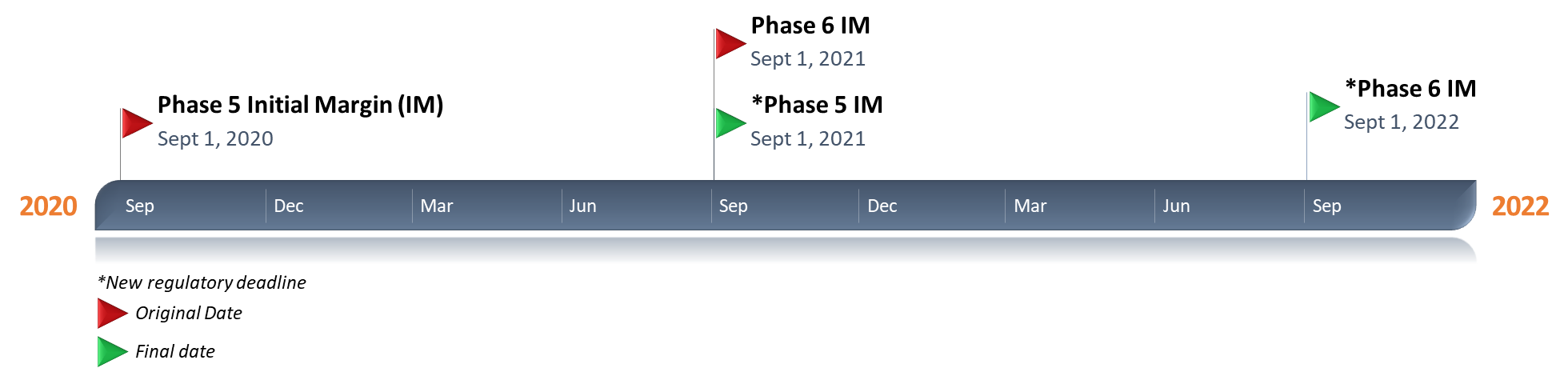

In April 2020, the Basel Committee on Banking and Supervision (BCBS) and the International Organization of Securities Commissions (IOSCO) extended the deadline for implementing Phase 5 and Phase 6 of the Uncleared Margin Rule (UMR) requirements for uncleared over-the-counter (OTC) derivatives. The US Prudential Regulators adopted the revised BCBS/IOSCO Phase 5 and 6 implementation dates on June 25, 2020. The deadlines for UMR Phase 5 and 6 have both been extended by one year and are now set for September 1, 2021, and September 1, 2022, respectively.

Prior to the late June US adoption, several other national regulators, including those in Japan, Canada, and Brazil, had already agreed to adopt the revised dates. The earlier adoption of the revised implementation dates allowed firms in those jurisdictions to avoid unnecessary efforts towards Phase 5 compliance in 2020. By contrast, many US firms continued to progress towards the September 1st, 2020 go-live date, given the absence of authoritative regulatory guidance. At this point, US firms need to decide whether to continue their work towards Phase 5 readiness or delay their program timelines to align with the new 2021 timeline.

Exhibit 1: New UMR Compliance Dates

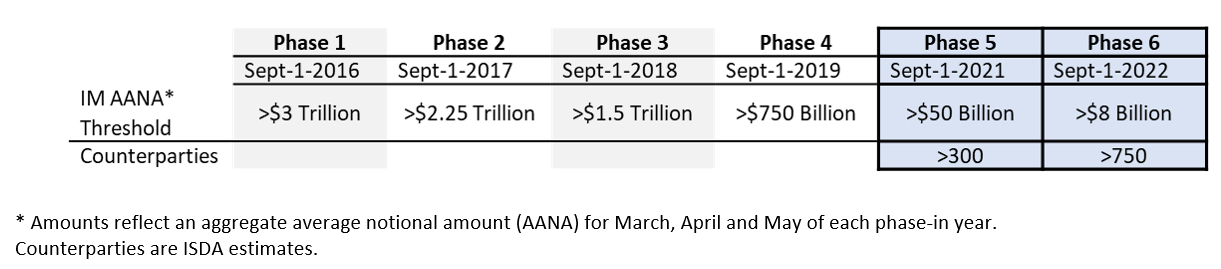

Projections have shown that for Phase 5 and Phase 6, the number of OTC market participants subject to the stringent initial margin (IM) regulatory requirements will explode from a few dozen to thousands of entities. The significant increase in covered entities is the result of the lowered average aggregate notional threshold from $750 billion in Phase 4 to $50 billion in Phase 5. In Phase 6 the threshold is further lowered to $8 billion, which brings a large number of mid-size corporates and smaller investment funds into the scope of UMR regulations. All counterparties are already subject to the variation margin (VM) requirements adopted in March 2017. However, complying with IM requirements is a much more complex challenge.

Exhibit 2: UMR Phases 1 - 6

The Case for Delaying UMR

The COVID-19 pandemic has created challenges across the financial industry, which is reflected in BCBS and IOSCO’s decision to delay the last two margin regulation phases. With countries being on lockdown, employees were forced to transition to a work from home environment and while many firms have displayed resiliency, others have not been as fortunate. This has caused the physical dispersion of resources, high market volatility, and other uncertainties that may arise due to the COVID-19 pandemic. BCBS/IOSCO recognized the need for additional time, which was widely embraced by firms impacted by the mandatory IM rules.

UMR is not the only major regulatory initiative that is being delayed due to COVID-19. The implementation timelines for several other regulatory initiatives, including Consolidated Audit Trail (CAT) and the Current Expected Credit Losses (CECL) accounting standards, have been pushed to later dates as well. Other regulatory-driven initiatives, such as LIBOR transitions, have seen a delay of interim dates. A comprehensive list of pending regulatory initiatives impacted by COVID-19 can be viewed here.

Impact on Firms and Counterparties

For the most part, the BCBS/IOSCO delay was welcomed by market participants. Major benefits for dealer banks and their counterparties include:

Time to readjust to the current implications of COVID-19, such as redirecting resources to focus on market volatility and enterprise resiliency. Firms can also reallocate resources and funding to other high priority go-live activities not impacted by COVID-19 delays.

The number of counterparties coming in scope for UMR Phase 5 compliance is much greater than what firms encountered in prior phases. The extension will allow for more time to onboard additional counterparties that were not in scope during previous phases.

Any additional preparation, testing, and validation that is needed can also benefit from this delay.

However, the delay has a few drawbacks, including:

Firms that budgeted for a Phase 5 go-live in 2020 may have to request additional funding for 2021 and 2022. All efforts towards a September 1st go-live in 2020 are now a sunk cost and firms may have to rescope their 2021 and 2022 efforts.

The delay gives counterparties more time to decide if they want to continue trading in uncleared OTC derivatives products that require IM. If more counterparties decide to post IM, this will translate into higher operational costs, triggered by additional legal and onboarding activities.

Firms subject to IM requirements in 2021 should make plans to adapt their business practices and support capabilities in the areas of legal documentation, trade pricing, and risk management, as well as collateral management. Likewise, large financial institutions that act as market-making counterparties to small and medium-sized market participants need to ensure they have the appropriate capabilities and processes in place. Their ability to scale rule adherence with a large number of customers is a critical driver in their capacity to sustain and grow their OTC derivatives businesses.

Drive Operational Improvements

With the one-year delay of UMR Phase 5, firms now have a unique window to implement strategic solutions into their UMR operational processes. Automation is a key lever to improve risk management, increase efficiency, and reduce costs within the UMR workflow. Automation also enhances business continuity options in times of economic stress or in the aftermath of major disruptive events, such as the current Covid-19 pandemic. Given the previous implementation deadlines, most banks still had to rely on time-consuming manual processes in the UMR collateral lifecycle. For example, introducing automation into the IM dispute resolution process can help identify and resolve recurring disputes with known root causes. Developing strategic, automated resolution processes allows for a much more efficient allocation of dispute resolution resources. Additionally, implementing standardized messaging formats for the pledging and release of collateral with third-party custodians reduces the reliance on antiquated (fax) and unstructured (e-mail) tools still broadly in use today. Further automation opportunities can be identified by deploying data mining and machine learning techniques. While notional amount and age of dispute are the obvious drivers of dispute priority, other data points such as historical trading activity, credit risk profile, and the counterparty’s dispute history may reveal other criteria that can be used to determine risk and workflow priorities. Firms that make good use of the additional time available will find creative ways to optimize their UMR processes, which can yield significant long-term ROI.

About Monticello

Monticello Consulting Group is a management consulting firm supporting the financial services industry through deep knowledge and expertise in digital transformation, change management, and financial services advisory. Our understanding of the competitive forces reshaping business models in capital markets, lending, payments, and digital banking are proven enablers that help our clients remain in compliance with regulations, innovate to be more competitive, and gain market share in new and existing businesses. By leveraging our regulatory advisory and automation, Monticello guides its clients from idea through implementation with confidence and resilience.

Get In Touch

LEARN MORE ABOUT MONTICELLO AND PURSUE OPPORTUNITIES WITH OUR TEAM