Engagement Summary

In late-2018, Monticello Consulting Group (Monticello) partnered with the regulatory compliance within the capital markets unit at a leading bank on the U.S. QFC STAY project. This engagement aimed at addressing the key regulatory challenges and creating a governance process focused on structuring remediation efforts for counterparties with in-scope Qualified Financial Contracts (QFCs). Monticello’s engagement on this project was multifaceted; provide advisory on translating complex regulatory requirements into technological solutions, manage and deliver the end-to-end execution of a risk and control process across sales and trading units, and provide stakeholders and senior leadership teams a clear remediation strategy for key risks and issues.

In preparation for the go-live initiative for U.S. QFC Stay, Monticello partnered cross-functionally with business and technology groups to create a consolidated report that systematically captured counterparties that are in-scope for the regulation to determine the population and assess the counterparty-risk. In conjunction, the team enhanced existing proprietary applications within the capital markets unit with relevant U.S. QFC Stay information to ensure connectivity between all platforms and downstream systems. Throughout the initial business gathering and requirement phase, Monticello was able to successfully manage and coordinate the release management process across multiple departments.

Once the first regulatory phase-in date for U.S. Global Systematically Important Banks (GSIBs) passed, Monticello’s focus shifted to creating a defined governance structure to effectively track and monitor regulatory risk globally across Sales & Trading. The creation of the Post Trade Reporting (PTR) process enabled senior leadership to gain visibility and insight into i) non-compliant trades with clients ii) business requirement gaps and refinement required iii) outstanding notional exposure and counterparty risk. As the regulation continued and scope of counterparties widened, our team was responsible for redesigning the existing process to capsulate all new business requirements. By continuously improving the PTR process through the course of the regulation, Monticello was able to keep up with the changing expectations from the business to deliver a robust and effective risk and control process. This became the standard operating procedure for the bank and was quickly adopted into business as usual activities.

Case Study Detail

PROJECT BACKGROUND

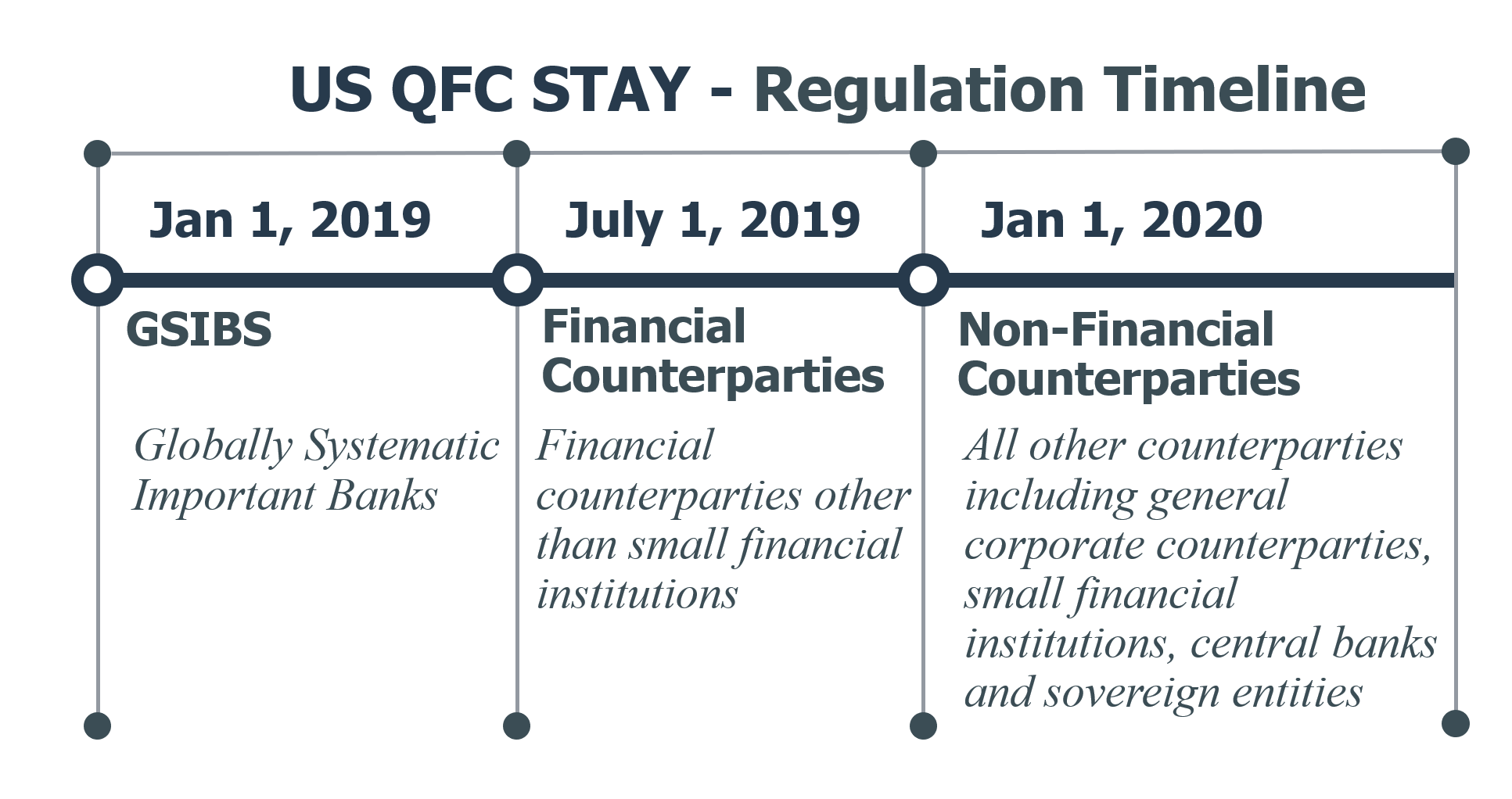

In response to the 2008 financial crisis and the economic collapse that followed, the U.S. banking regulators have adopted laws and regulations to employ a more orderly resolution strategy for GSIBs and their global affiliates. In 2017, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency published the final U.S. QFC Stay regulation rules. Combined the US QFC Stay regulations are a set of new requirements requiring GSIBs to amend their QFCs with all counterparties to agree to a short time window before claiming exercising default rights, to permit the transfer of QFC exposures of a failing bank, and to eliminate cross-default provisions from active QFC agreements. The goal of these changes is three-fold: i) allow a failing GSIB to transfer exposures governed by QFCs to the designated receiver (i.e. FDIC); ii) provide the FDIC with a minimum of 24 hours to assess the QFC exposures of the failed GSIB and decide what actions to take; and iii) prevent cross-defaults to other legal entities of a failing GSIB. In combination, these changes are designed to prevent a repetition of the problems encountered during the bankruptcy filing by Lehman Brothers Holdings, Inc (LBHI) in 2008.

ENGAGEMENT OBJECTIVES

Regulatory Advisory: Prescribed viable strategic and technological solutions to complex requirements to ensure the bank stays ahead of the regulation and remains competitive while undergoing a large-scale regulatory transformation.

I. Analyzed provisional and contractual terms for protocol adherence and bilateral amendments to Qualified Financial Contracts.

II. Liaised with Legal and Business to advise impacted counterparties on remediation process through three regulatory phases.

III. Developed requirements to design an end-to-end consolidation report which provides stakeholders visibility into their account setup, investment advisor, beneficial owner, and global legal parent.

Financial, Risk, and Controls: Designed and oversaw the execution of a Post Trade Reporting process used to monitor the bank’s global trading activity across all in-scope counterparties.

I. Created a monitoring and control process used to identify, track, and remediate non-compliant trades. Partnered with Sales & Trading, Business, and Legal to define in-scope transactions and products, determine trade exceptions, and develop a remediation plan for violations.

II. Established escalation procedures and communication plans for regulatory risks.

III. Developed KPIs and reporting metrics for management communications. Addressed and escalated risks and issues while attaining necessary sign-offs required for completion of documentation and processes.

BUSINESS VALUE

Monticello Consulting Group provides services across the financial services industry to tackle the latest regulatory changes. By working with clients to understand the complex nature of business requirements and assess the impact it has on both existing and new business models, Monticello enables clients to implement the necessary risk and control framework to ensure compliance. Our team partnered with Business, Legal, Technology, and Sales & Trading to develop business requirements and oversee the end-to-end execution of an enterprise-wide risk and control process for the QFC program. By leveraging our regulatory knowledge, project management expertise, and proven governance standards, Monticello successfully ensured global trading activity was undisrupted while undergoing a business-critical regulatory initiative.